Tent halls are gaining in popularity as quick and cost-effective solutions for various needs, such as warehouses, production halls or spaces for various types of parties or events. This raises the question: is a marquee hall a building and does its erection require planning permission? In this article we will take a closer look at the legal definitions and tax consequences associated with marquee halls

Tent halls are gaining in popularity as quick and cost-effective solutions for various needs, such as warehouses, production halls or spaces for various types of parties or events. This raises the question: is a marquee hall a building and does its erection require planning permission? In this article we will take a closer look at the legal definitions and tax consequences associated with marquee halls

Is a marquee hall a building or a structure?

In order to answer the question: Is a tent a building , reference should be made to the definition in the Construction Law. According to it, a tent hall does not meet the definition of a building, as it is not permanently attached to the ground, has no foundations and can be easily dismantled and moved. However, according to the Construction Law, a tent hall can be classified as a building as it is a structure that is neither a building nor a small structure. Tent hall a building or a structure? In the judgment of the Provincial Administrative Court in Warsaw of 13 March 2018. (ref. III SA/Wa 1021/17) states that tent halls, despite not being buildings, may be treated as structures, which means that they are at least subject to property tax.

Tent hall and planning permission

The question of whether a marquee hall is a building and whether it requires a building permit depends on the period for which the structure is to be erected on the site. Building law distinguishes between two types of marquee halls.

- Temporary halls: These are structures intended to be used for a period of less than 180 days. In this case, it is sufficient to declare the intention to erect a hall to the Town Hall or County Office.

- Year-round halls: These are facilities which are to be used for a period of more than 180 days. In this case, a building permit must be obtained.

In the context of property tax, tent halls are classified as temporary structures. According to the regulations, property tax covers land, buildings and structures related to the operation of a business. Tent halls, as temporary structures, can be taxed if they meet certain conditions.

Tent halls and property tax

In the context of property tax, tent halls are classified as temporary structures. According to the regulations, property tax covers land, buildings and structures related to the conduct of business activities. Tent halls, as temporary structures, can be taxed if they meet certain conditions.

Tent hall – building or structure?

Is a tent hall real property? In the context of construction law, a tent hall is not classified as a building, but as a structure. This is an important distinction because structures are subject to different legal regulations than buildings. In practice, this means that different regulations for obtaining planning permission and taxation regulations apply to marquee halls. As a result, owners of marquee halls have to comply with specific legal requirements that differ from those applicable to traditional buildings. This differentiation is intended to adapt the regulations to the specific construction and use of each building. In this case, the tent hall vs. property tax is an obvious question.

Is a tent hall real estate?

Although a tent hall is not a building permanently attached to the ground, its erection may require planning permission. A key factor in determining the need for permission is the intended lifetime of this temporary structure. If the marquee hall will be used seasonally and dismantled after that period, a building notification to the relevant authority is usually sufficient. However, if you intend to use the hall year-round, a formal building permit will be required.

Temporary event halls, banquet halls and even those for industrial purposes that will not remain for more than 180 days can operate under a simpler notification. Any hall in use beyond this period is treated as a permanent structure, which absolutely requires the appropriate building permits.

Advantages of marquee halls

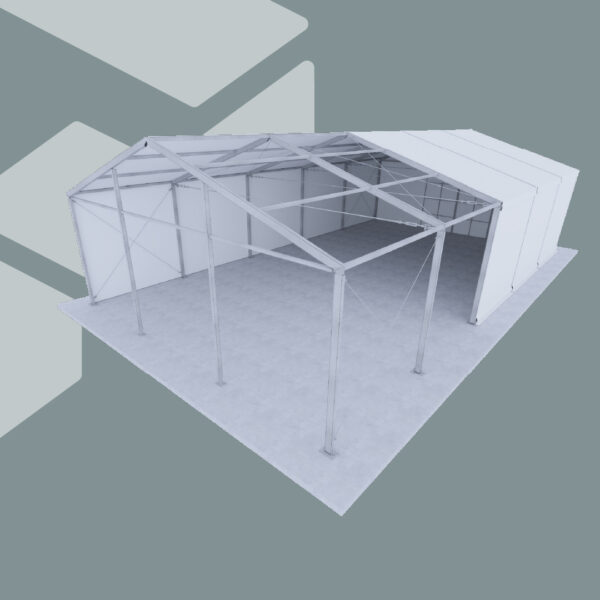

Marquee halls are gaining popularity in various sectors of the economy. Thanks to their design and ease of assembly, companies can react quickly to changing needs, develop new projects or increase storage space in a short space of time.

Industrial halls are also financially advantageous, as their construction and maintenance costs are usually lower than traditional buildings. Investment in such infrastructure usually also requires less initial capital.

In addition, the mobility of such structures makes it possible to move or dismantle them in the event of a change of business location. In practice, this means that companies can easily adapt to new conditions. This feature is particularly valuable for industries with seasonal operations, such as agriculture, events or construction.

The marquee halls are made of durable, weather-resistant materials to ensure stability and safety. The highest quality structures, such as those offered by Pol-Plan, have additional thermal insulation options, making them suitable for use all year round – in both hot and cold weather.

As a result, marquee halls are becoming a strategic tool for companies looking for flexible and efficient ways to grow and optimise resources. With all these advantages, investing in marquee halls can help to increase competitiveness in the market and provide businesses with the flexibility they need in a dynamic business environment.

Why invest in halls from Pol-plan?

This is due to the excellent quality of construction, the use of top-quality materials and an in-depth knowledge of current legislation. Pol-Plan combines modern technology with experience, which guarantees the durability, functionality and safety of each structure. Investors can count on full support at every stage of the project, which translates into optimising costs and maximising benefits.